Stay on Top of Financial Markets!

Our mission is to make financial markets accessible through easy-to-use charts, empowering you to spot trends and stay informed.

Our mission is to make financial markets accessible through easy-to-use charts, empowering you to spot trends and stay informed.

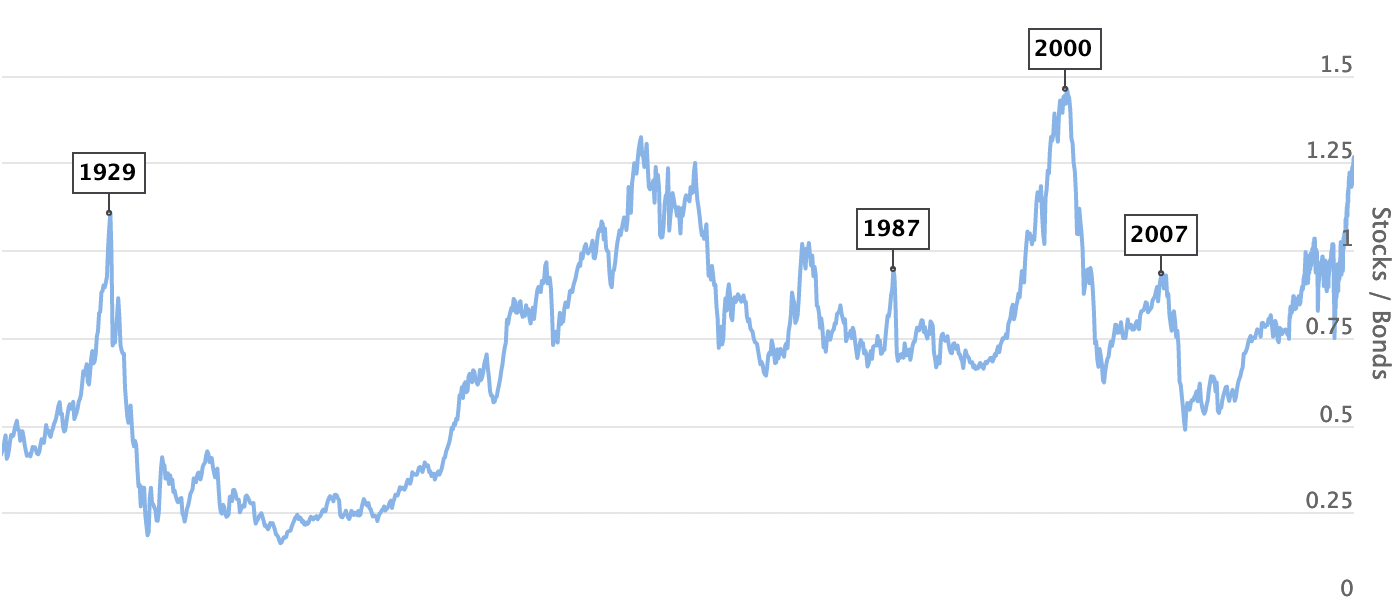

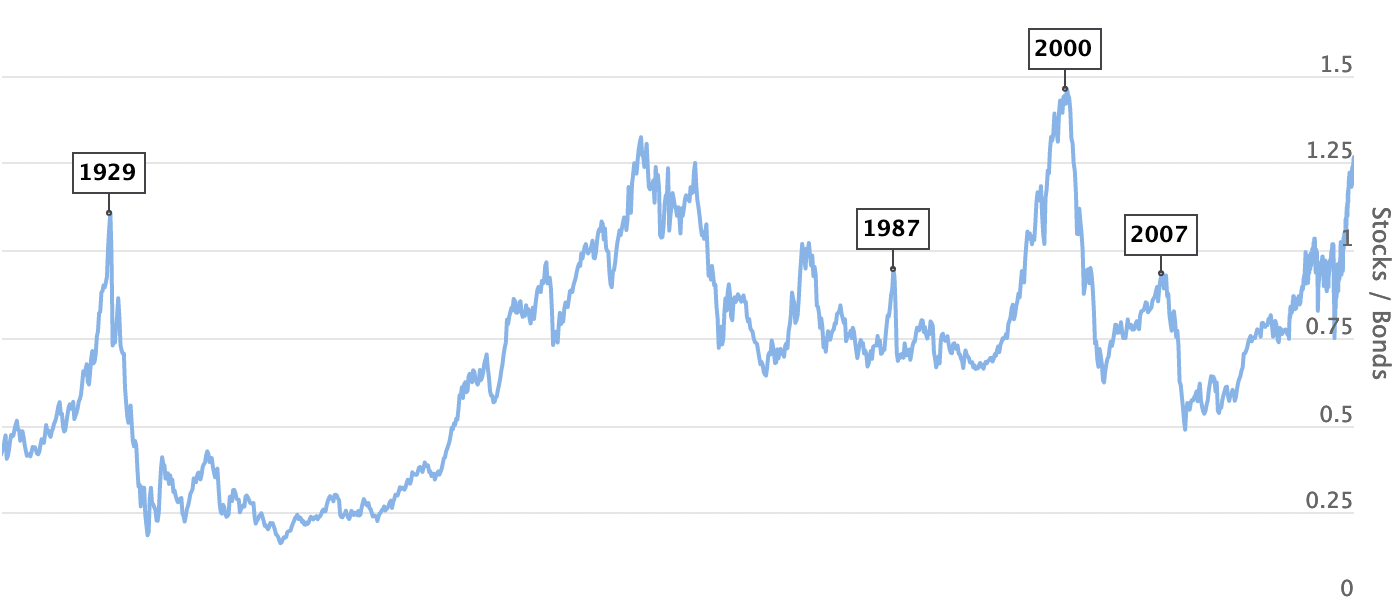

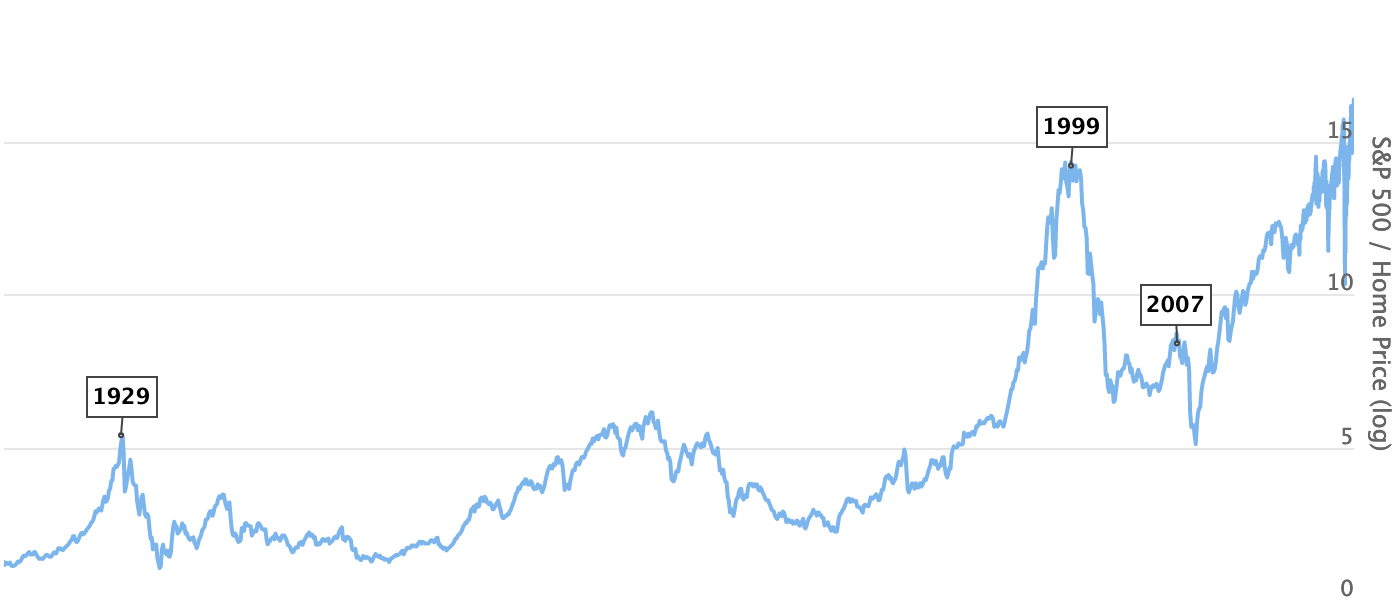

The Stocks to Real Estate ratio divides the S&P 500 index by the Case-Shiller Home Price Index. Just like Market Cap to GDP, it has an interesting historical track record and clearly shows the stock market bubbles of 1929 and 1999.

An error appeared while loading the data. Maybe there is a technical problem with the data source. Please let me know if this happens regularly @silvan_frank.